This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Timeline

IPscore ® was developed in the early 2000s by Danish Patent and Trademark Office (DKPTO) in collaboration with Professor Jan Mouritsen, Copenhagen Business School, and some Danish companies. This name was trademarked in Denmark in November 2000 (VR200100284), then in the European Union in March 2003 (EUM003108545). It relates to a software tool for the assessment and strategic management of patents and development projects. The aim of this tool is to provide a qualitative assessment of a patented technology based on five groups of criteria (A – Legal status, B – Technology, C – Market conditions, D – Finance and E – Strategy).

The European Patent Office (EPO) acquired the rights of IPscore® from DKPTO, with the aim of making the program available free of charge to the patent offices of all its member States. The tool is intended to provide a preliminary examination of the value of a patent portfolio and provide information that can be used by patent attorneys and capital investors. To date, the EPO is still the owner of the IPscore® EU trademark, renewed for ten years in July 2013 and again in June 2023.

How it works

The last version of IPscore®, available free of charge on the EPO website, dated back to December 2009 and only worked with Microsoft® Access 2003. During a webinar organized by the EPO at the end of April dedicated to the assessment of intellectual property assets, a new version of the tool (IPscore® 3.0) was presented to participants. This is an Excel spreadsheet comprising a tab for each evaluation topic, followed by a tab containing graphical representations (“Output”).

As in previous versions, each of parts A to E comprises several questions (between six and nine), to which a score from 1 to 5 should be assigned.

This comprehensive questionnaire covers a wide range of aspects which enable quality assessment of the patent(s) under evaluation. However, answering each question requires to be aware of a lot of information, particularly financial data (for example, the market growth in the business field to which the patented technology belongs, or the technology’s contribution to company profits as a percentage of accumulated profits).

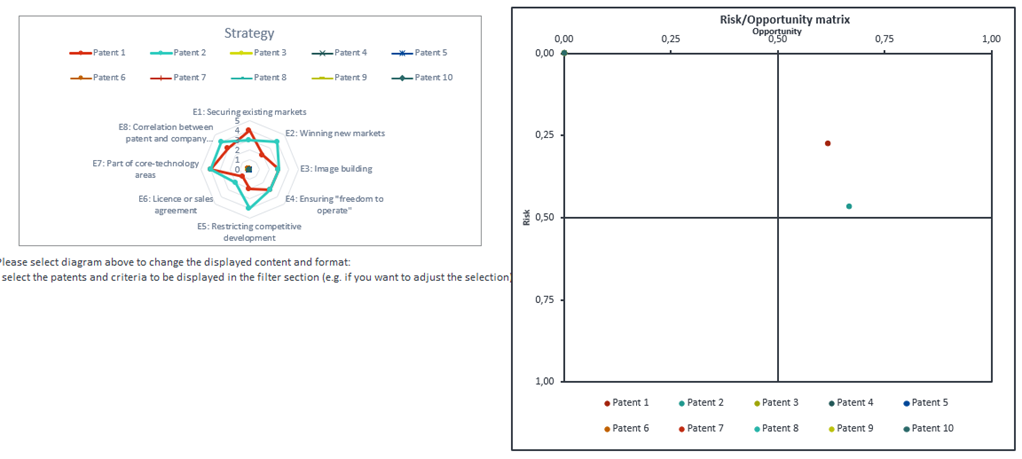

The questions are used to calculate the opportunity and risk percentages associated with each evaluated patent. The table below summarizes the questions used to determine these parameters.

| Parameters computed by IPscore® V3.0 | Questions taken into account when calculating parameters |

| Risk value (%) | A1, A2, A3, A5, A6, A7, A8, B2, B3, B4, B5, B6, B7, B8, C1, C4, C9, D2, D3, D4, D5 |

| Opportunity value (%) | A3, A4, A5, B1, B2, B9, C1, C2, C3, C4, C5, C6, C7, C8, D3 |

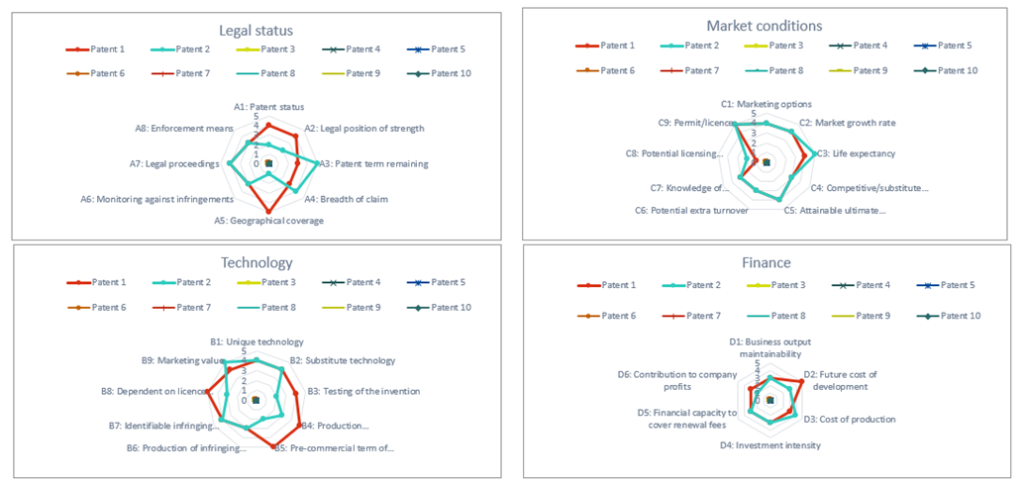

Once the questionnaire has been completed, the result is a risk/opportunity matrix, as well as spider charts (Kiviat diagrams) representing strengths and weaknesses in each of the five main evaluation topics (see figures below representing an example of an assessment of two separate patents). These graphical representations, which appear in the “Output” tab of the Excel table (IPscore® version 3.0), represent a significant improvement on previous versions of IPscore®.

Analysis

IPscore® has the advantage of combining legal, technological, marketing, financial and strategic evaluation topics for one or more patent(s)/patent application(s) in a single tool. This multi-criteria analysis covers economic, legal and technological aspects, in line with the recommendations of intangible asset valuation standards such as ISO 10668[2]. The fact that the database is available free of charge also facilitates access for as many people as possible to a tool for quality assessment of a patent portfolio. The legal status section, which is fairly simple to fill in, enables the assessment of patent validity (question A2), scope of claims (question A4) and discoverability of infringement (question A6), which are the three essential criteria for determining the quality of a patent according to Larry M. Goldstein, US patent attorney and author of the book “True Patent Value” published in 2013.

However, evaluating these criteria with IPscore® can be improved, given the following points:

- the validity of a patent is assessed solely on the basis of whether a prior art search has been carried out as of the evaluation date, without taking into account the content of the claims. Thus, a patent application that has not yet a Search Report will in all cases be judged less “valid” than any patent that underwent a search by a Patent Office, regardless of what is claimed and even of the citation categories in the Search Report or of the relevance of the documents identified in the search that the patent owner would have carried out;

- the discoverability of infringement is assessed solely on the basis of whether or not a watch of the competitors’ products is made, and does not take into account statistics related, for example, to the presence of third parties among the citing patents of the evaluated document.

In addition, the IPscore® questionnaire is quite time-consuming to fully complete, given the amount of information required to answer the various questions. This can be a hindrance when the assessment needs to cover more than a dozen of patent families, as a typical SME/ETI may own.

For more information on patent quality assessment tools, we refer you to our series of articles published in 2021, which present the main existing methods as well as a new scoring method (“How to assess patent quality?”, part 1 and part 2).

If you have any questions about tools and methods for qualitative and/or financial assessment of your intellectual property assets, please do not hesitate to contact our “Contracts, IP Valuation & Data” and “IP Intelligence” Departments.

[1] At the end of April, on the occasion of a webinar dedicated to the assessment of intellectual property assets (IP assessment: how to improve informed decision-making)

[2] ISO 10668:2010 – Brand valuation — Requirements for monetary brand valuation

To keep in mind

Methods such as IPscore®, which highlight the value potential of a patent or patent application, are the first building block in the process of assessing a patented technology by providing an index of depreciation of the patent value that can be used after applying one or more financial valuation methods to estimate the most accurate price associated with a patent. The main methods used for assessing the financial value of a patent will be the subject of a specific article to be published soon.